The business account for LatAm startups building good sh*t

Manage your startup’s runway, move capital across borders, and keep your flow of funds compliant.

Trust. Confiança. Confianza.

We don't play around when it comes to your money.

We only work with chartered banks in the United States to hold your funds, and licensed foreign exchange banks in Latin America to move capital across borders.

Up to $5MM in FDIC coverage

Up to 20x the industry standard of USD $250k per entity.

Accounts in your name

Funds in Latitud Finance accounts are held in your name, not ours.

No hidden fees

No hidden fees. No hassles. No bull.

For founders, by founders

We built this solution with the help of a community of 1.2k+ founders who needed it

Latitud is not a bank. We are a Financial Technology company that works with FDIC-insured depository institutions in the United States. We work with the following network of partner banks to offer extended FDIC coverage of up to $5MM per entity. Please note that FDIC deposit insurance coverage only protects against the failure of an FDIC-insured depository institution.

I loved how transparent Latitud was

I loved how transparent Latitud was. All the fees were available up front. I got excellent customer service from Latitud — we got onto a call and in 15 minutes, they answered all my questions. They took over the end-to-end process for us. That was the game changer when choosing an FX partner.

How does it work?

- 0

- 1

- 2

- 3

Tell us who you are

20 minutes

Relax, it's not an interview

We just need a couple of documents for each of your startup's entities, along with a few documents for you and your co-founders.

If you incorporated with Latitud Formation, it's even easier: check a box to share your docs with us and record a selfie video — no filters please.

As fast as Senna, Perez, Montoya, and Fangio

Once we get to know you, we'll open US-based accounts for your offshore structure, including Cayman and US holding companies.

We don't require any account minimums or monthly fees, and we're not going to take weeks to get your accounts set up.

Time for investors to put their money where their mouth is.

You'll be ready to receive wire transfers as soon as your accounts are set up, and we'll share step-by-step instructions on how.

Don't worry, we'll have instructions for your investor's banking providers too — we'll make this as simple as possible.

Ka-ching! That's the sound of money hitting your account.

We'll transfer funds as you need them from your Latitud Finance account to your local accounts in Brazil and Mexico — compliance with local and offshore regulations included.

We give you the wholesale market rate and charge a fixed spread. We don't hide fees in your exchange rate. For large transfers, we negotiate on your behalf to get you the best rate.

Build and find

Product Market Fit

You're on your own on this one*

*Okay, technically you're not if you're part of the Latitud Fellowship

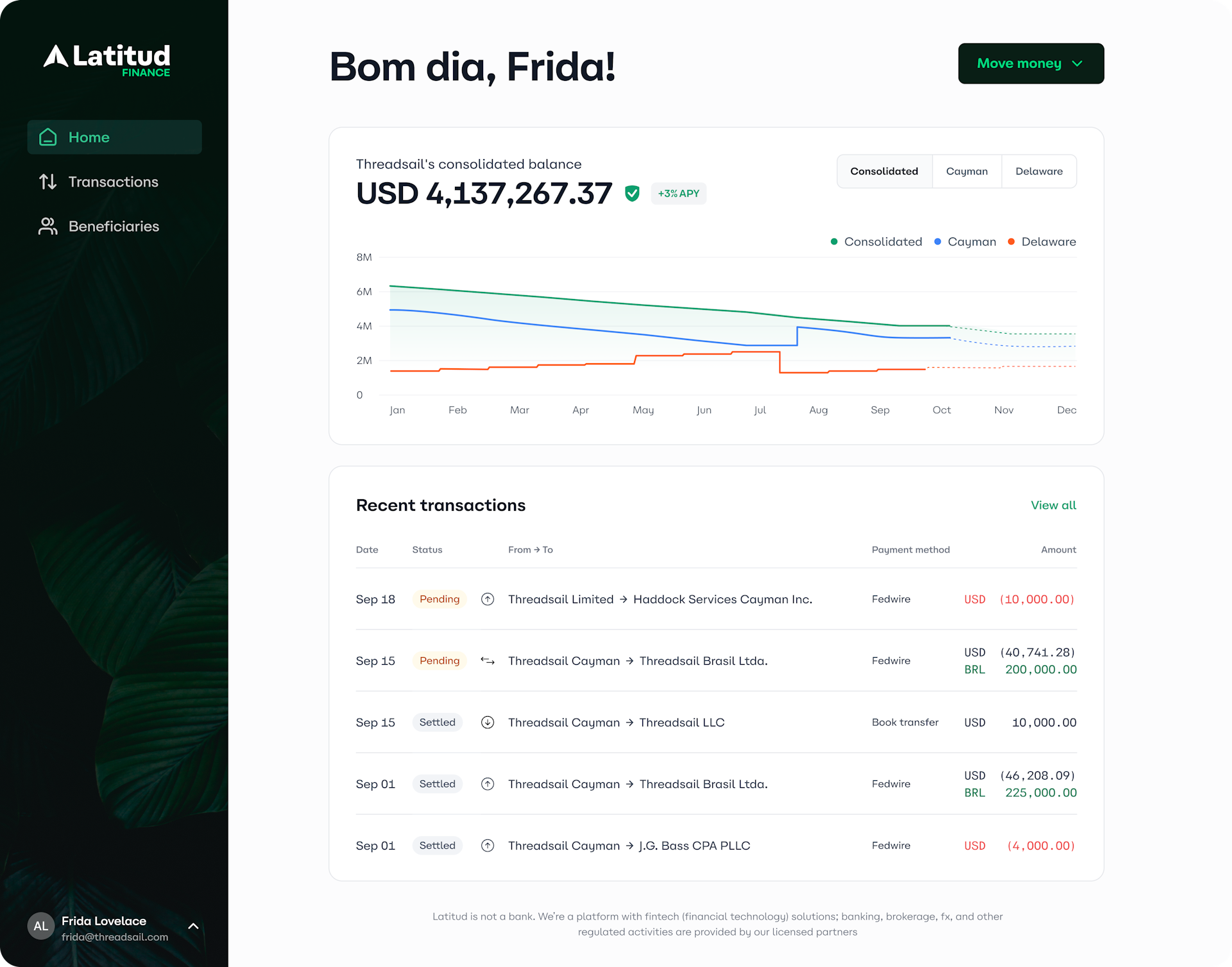

Your offshore accounts in one place

Open business accounts for all entities in your offshore structure, including your Cayman and US entities.

- No maintenance fees or minimum balances

- 3% APY interest on your funds

- Up to USD $5MM in FDIC coverage per entity

Integrated foreign exchange

Transparent international transfers from your offshore structure to your operating companies in Brazil and Mexico.

- Market rate (Reuters) for transfers, no hidden markups

- Transparent fees, with no surprise costs

- FX fees starting at 0.25%, lower for high value transfers

Compliance on autopilot

Make every transaction with the peace of mind that you’re following Cayman, US, Brazilian, and Mexican corporate regulations.

- Handle central bank filings and bylaw updates for Brazilian companies

- Correctly structured transfers through your Delaware holding company

- Automatically sync statements with Latitud Compliance

Frequently asked questions

Who can use Latitud Finance?

Startups who have either a Cayman Sandwich, a Delaware Tostada, or another US holding company structure can use Latitud Finance. We only support operating companies in Brazil and Mexico for international transfers (FX). If you're using another corporate structure or have operating companies in other countries, please get in touch!

How does Latitud Finance keep my money safe?

We work with licensed partners in the United States and Brazil to custody funds and offer compliant FX services. Our partners hold funds on behalf of our customers in up to 20 FDIC-insured banks in the United States. This allows us to offer up to $5MM in FDIC coverage per entity.

How much does Latitud Finance cost?

There is no fee to sign up for Latitud Finance, nor is there a monthly maintenance fee. You can find more information about our fees at the following link.

Are there any tax implications for using Latitud Finance?

Latitud Finance does not provide tax advice. However, using a Latitud Finance account as intended will not impact your corporate structure's tax integrity. You should not pay for local operating expenses from your Cayman or Delaware business account. Please consult your own tax and/or legal counsel regarding your company's specific tax position.

Is Latitud Finance limited to Latitud Formation customers?

No, we work with folks who have incorporated their company without using Latitud Formation too! Signing up for Latitud Finance is a simple process, and we'll let you know what documents are required.

More questions? Check our our help center or get in touch with us.